As the digital clock ticks, a significant event has unfolded in the world of finance and investment fraud recovery—the launch of the Global Standard Bank Settlement Program. This initiative marks a pivotal moment GSPartners victims, offering them a pathway to reclaim what was once considered irretrievably lost. Here’s a detailed look into what this means, how it came to be, and what victims can expect.

The Backstory: GSPartners Downfall

GSPartners, once pitched as a revolutionary investment platform, promised returns that seemed too good to be true because, as it turned out, they were. The scheme, led by Josip Heit and associated with entities like Swiss Valorem Bank, was exposed as a multi-level marketing (MLM) scheme violating securities laws across multiple jurisdictions. Regulatory bodies from the US, Canada, and beyond issued warnings, and by late 2023, GSPartners had collapsed, only to attempt a rebrand as GSPro, which did little to salvage its tarnished reputation.

GSPartners Settlement: A Beacon of Hope

The turning point came with a settlement announced in early 2024, where GSPartners, now under the scrutiny of several state securities regulators in the US, agreed to terms that would see investors receive refunds. This settlement, while initially covering only a few states, has now expanded, aiming to include victims globally through what’s been termed the Global Standard Bank Settlement Program.

CLICK HERE to see our previous reporting on the Texas State Securities Board Settlement

Global Standard Bank Settlement Program: The Program’s Launch and Mechanics

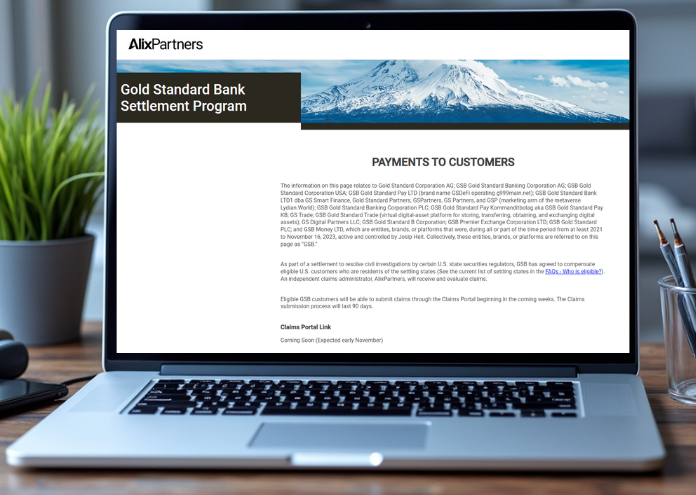

As of mid-September 2024, the settlement website for GSPartners victims has gone live, heralding the beginning of the claims process. This program, managed by AlixPartners, a neutral third-party chosen to oversee the claims, outlines a structured process for victims:

- Eligibility: GSPartners Victims need to prove their investment in GSPartners with documentation, including any KYC materials, account IDs, and transaction records.

- Claims Portal: Expected to open in early November, this portal will be the gateway for victims to submit their claims. Here, they’ll need to detail their investment and losses, backed by proof of transactions.

- Compensation: The goal is to compensate based on the net investment after withdrawals, aiming to return as much of the lost funds as possible. Those GSPartners victims successfully verified will receive an offer, which, if accepted, should see payouts shortly after.

- Duration: The claims submission window is set for 90 days, emphasizing urgency for those affected to act swiftly.

Implications and Expectations

The launch of this program isn’t just a procedural step; it’s symbolic. For victims, it represents not only a chance at financial recovery but also a form of justice against scams that exploit trust and greed. However, the settlement process isn’t without its challenges:

- Documentation: Many victims might have lost or misplaced their investment records. The onus is on them to gather or recreate these documents, potentially requiring legal or financial advisory services.

- Verification Delays: Given the volume of expected claims, processing might take longer than anticipated, leading to delays in payouts.

- Outcome Uncertainty: While the settlement aims for full restitution, the actual amount victims receive could be less, depending on various factors including legal fees and the operational costs of the settlement program itself.

The Broader Impact

On a macro level, this settlement program underscores a growing trend towards accountability in the financial technology sector, especially in the wake of decentralized and often unregulated investment schemes. It serves as a cautionary tale for potential investors about due diligence but also as a beacon of hope for regulatory frameworks that can adapt and protect.

The Global Standard Bank Settlement Program: Looking Forward

For those entangled in the GSPartners saga, the Global Standard Bank Settlement Program represents a critical juncture. It’s a call to action for GSPartners victims to engage with the process, however cumbersome it might seem, as a step towards recovery. For the broader financial community, it’s a reminder of the importance of regulatory oversight, transparency, and the evolving landscape of fraud and recovery mechanisms in the digital age.

As the claims portal opens and the stories of recovery begin to unfold, this program might just set a precedent for how future financial frauds are addressed, turning the page from victimhood to empowerment through structured legal and financial redress.

This article encapsulates the essence of the Global Standard Bank Settlement Program, offering insights into its operation, implications, and the broader context of financial recovery for GSPartners Victims in the modern era.